Наиболее простым и востребованным является стандартный индикатор терминала МТ4 – Volumes, отображающий количество сделок за определенный период времени. Отображается он в виде гистограммы, состоящей из параллельных вертикальных линий. Их высота означает количество совершенных торговых операций, а цвет – направление.Важно понимать, что индикатор Volumes показывает всего лишь количество сделок, а не торговый объем. В связи с тем, что рынок форекс не является регулируемым, торговые объемы не отображают достоверной информации общего настроения трейдеров. Индикаторные данные показывают количество проданных и купленных контрактов в конкретный промежуток времени в конкретной брокерской компании. Тиковый объем – количество колебаний цены за определенный период времени.

Это счет, торгуя на котором вы имеете доступ к такой ячейке, пулу провайдеров ликвидности. Соответствует наличию бара с минимальным спредом и крупным объемом. Возникает в конце трендов, когда акции передаются от маркетмейкеров трейдерам, и когда прибыль получают в середине торгов. Если к сильному уровню, например — сопротивлению, цена подходит на пониженных объемах (сильная дивергенция), высока вероятность, что уровень не будет пробит. Кажется, что реальный централизованный рынок, там ведь должно отображаться, кто и сколько купил или продал.

Котировки валютных пар в реальном времени

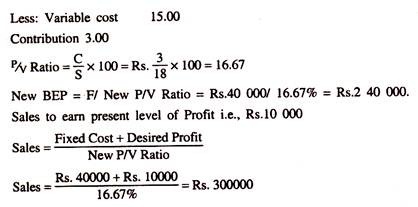

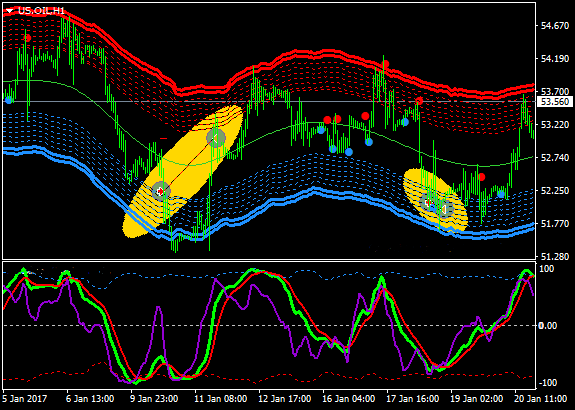

И наконец, в течение одной секунды один трейдер заключает прибыльную сделку, а второй убыточную. А некоторые с помощью различных индикаторов берут данные с разных источников, где якобы реальные объемы, и встраивают их в свою торговую систему. Вертикальный объем это – данные о проведенных сделках, которые располагаются под ценовым графиком в виде столбиков (См. Рис. 1 и 2). Каждый столбик отображает определенное число операций, провелись за таймфрейм, выбранный в терминале. На часовых графиках показано количество инструментов, перемещенных между трейдерами за один час, на дневных графиках — за день и так далее.

- Появляется в конце трендов, а также во время коррекций.

- Однако существует несколько сложностей, в силу которых довольно сложно в точности определить торговые объемы на валютном рынке.

- Но даже они не могут сказать, каков реальный объем операций, осуществляемых на бирже.

- Рекомендуем также изучить индикатор ClusterDelta Volume для MT4.

- Формирование рынка определяется тремя факторами – объемом, ценой и временем.

Образовавшаяся дивергенция свидетельствовала в сторону назревающего разворота. Во время устойчивого бычьего тренда на объеме образовался новый максимум, который похож на «всплеск эмоций». Многие трейдеры на этом максимуме зафиксировали свои прибыльные позиции. Объем отображает психологическое настроение трейдеров и позволяет толковать перепады цен.

Вся информация представлена исключительно в ознакомительных целях и не может являться руководством для практического использования. Администрация сайта не несет ответственности за какие-либо действия, либо за возможный ущерб, полученный в результате ознакомления с материалами. Пользователь полностью отвечает за любую неправильную трактовку, которая может возникнуть вследствие просмотра, чтения или копирования сведений, содержащихся на странице. Белый цвет имеет прямо противоположное значение. Этот сигнал индикатора Better Volume трактуется трейдерами как начало нисходящего тренда, либо его итоговый импульс.

Объемы на рынке Форекс: где и как посмотреть и стоит ли им верить

Цены на криптовалюты чрезвычайно волатильны и могут изменяться под действием внешних факторов, таких как финансовые новости, законодательные решения или политические события. Маржинальная торговля приводит к повышению финансовых рисков. Наш комплексный и удобный в использовании график Форекс в режиме реального времени поможет вам отслеживать динамику тысяч валютных пар на международном рынке Форекс. Графики включают в себя новости и экономические события.

К тому же, сам автор VSA в своей книге “Хозяева Рынков” четко и ясно говорит о возможности использования тикового объема. Кстати говоря, в программе TradeGuider, выпускаемой под его присмотром, для анализа рынка форекс тоже используется именно тиковый объем. Фьючерсы на валюты торгуются на Чикагской товарной бирже , сокращенно CME. В целом объемы торгов на валютных фьючерсах дают схожую картину с происходящим на спот-рынке и могут использоваться для анализа ситуации на форекс. Рассматриваемый вид анализа предполагает выявление уровней цены, на которых состоялось наибольшее количество сделок по определенному типу инструмента.

Какие объемы на форексе?

Напротив каждого инструмента есть иконка, кликаем по ней и наблюдаем график. Если не сможете разобраться, то посмотрите видео. В сети катастрофически мало источников, которые могут предоставить нам данные по объему с CME бесплатно. Это платный индикатор, стоимость лицензии составляет 88$ (на 5 аккаунтов). Инструмент похож на Better Volume и входит в набор стратегии Pipfinite. 6 лучших проверенных тактик при работе на рынке по данному методу.

Например, у тех брокеров, кто дает возможность торговли на CME. Зеленый цвет столбца говорит о наличии на валютном рынке достаточно большого объема торговых сделок как с бычьей, так и с медвежьей стороны. Это указывает на фиксацию прибыли маркет-мейкерами и обмен торговыми ордерами. Как правило, вскоре после появления зеленого сигнала ценовой график меняет свое направление. Красный цвет столбца указывает на большой торговый объем, который может свидетельствовать либо о зарождении восходящей тенденции на ценовом графике, либо о ее конечном импульсе.

Наиболее достоверные объемы Форекс онлайн можно узнать у таких крупнейших брокеров, как Альпари, имеющих максимальное количество клиентов. Но даже они не могут сказать, каков реальный объем операций, осуществляемых на бирже. Все права на интеллектуальную собственность сохраняются за поставщиками и (или) биржей, которые предоставили указанные данные.

Высокая ликвидность, благодаря которой можно беспрепятственно покупать и продавать большие объемы в любо время. FOREX (от английского FOReign EXchange) – крупнейший финансовый рынок мира, на котором идет торговля денежными единицами. Сайт АЭИ “Прайм” предоставляет данные в сотрудничестве с платформой TradingView с использованием технологии Flash-изображения. Это дает возможность публиковать данные с минимальными задержками, обусловленными особенностям веб-интерфейса. Высокая ликвидность, благодаря которой можно беспрепятственно покупать и продавать большие объемы в любое время. Десятки валютных пар, позволяющие использовать экономические и политические события всех уголков планеты для извлечения прибыли.

Форекс объемы: понятие и предназначение

Давайте же рассмотрим, какие виды объема бывают. Сразу скажу, что я буду брать только реальный, фьючерсный объем. Получается, на реальном рынке в графу «бъем запишется 200 контрактов, а на форексе было всего 2.

При осуществлении торговых сделок следует обязательно анализировать VSA. При этом учитывается не только количество сделок, но и местонахождение свечей. Рыночные аналитики регулярно мониторят объемы Форекс, составляя различные стратегические прогнозы. Если можно было бы собрать объемные данные всех брокерских компаний, существующих в настоящий момент времени, трейдерам было бы легче анализировать торговые активы. Но поскольку сейчас этого сделать нельзя, отталкиваться приходится от объемов крупных брокерских компаний. Индикатор «реального» объема на ForexКак по мне, лучше уж брать объемы с реального фьючерсного рынка.

Во втором случае сработают как фильтр, остановив покупки на вершине тренда. Объем представляет собой важное дополнение к ценовому изменению для понимания «силы» тренда и уровня ликвидности в текущий момент https://goforex.info/ сессии. Это объясняет, почему индикатор входит в состав стандартных инструментов теханализа практически всех торговых платформ. Volumes – самый простой для понимания трейдера технический индикатор.

Трейдинг с использованием отчетов cme group

Возникает на старте и финише трендовых восхождений, а также в период коррекций на опускающихся трендах. Позволяет совершать объемы форекс в реальном времени максимум выгодных сделок, входя в них с коротким СтопЛосс. Это число акций, которые были куплены или проданы трейдерами.

Как узнать объем рынка Форекс?

И даже нет не то, что конкретного места на карте, где бы располагалась «биржа Форекс», а даже нет единого сервера, куда бы стекались все ордера трейдеров и фиксировались их объемы. Ну или, по крайней мере, простые смертные доступа к такому серверу не имеют и о самом его существовании доподлинно никому из нас не известно. То есть места, где можно посмотреть реальные объемы на Форексе просто не существует.

Объемы на Форекс по праву можно считать самым надежным “индикатором”. Если подобный уровень пробит ценовым графиком, то это может указывать на смену или интенсивное развитие тренда. Стоит сказать, что доступ к фьючерсной торговой площадке еще совсем недавно был ограничен. Ведь владение этими сведениями наделяло трейдера неоспоримыми преимуществами. Один из брокеров, предоставляющих данные об объемах внутри своего ECN — отличный FxOpen.uk, который представлен в нашем списке лучших брокеров. Электронный трейдинг здесь составляет не менее 95% от всего числа торговых операций.