LeDona Withaar has over 20 years’ experience as a securities industry professional and finance manager. She was an auditor for the National Association of Securities Dealers, a compliance manager for UNX, Inc. and a securities compliance specialist at Capital Group. She has an MBA from Simmons College in Boston, Massachusetts and a BA from Mills College in Oakland, California. She has done volunteer work in corporate development for nonprofit organizations such as the Boston Symphony Orchestra. She currently owns and operates her own small business in addition to writing for business and financial publications such as Budgeting the Nest, Zacks and PocketSense.

- Master R and Python for financial data science with our comprehensive bundle of 9 ebooks.

- Just like the initial receipt of the restricted contribution, the investment income earned on these endowment funds, which is restricted for long-term purposes, must be reported as a financing activity.

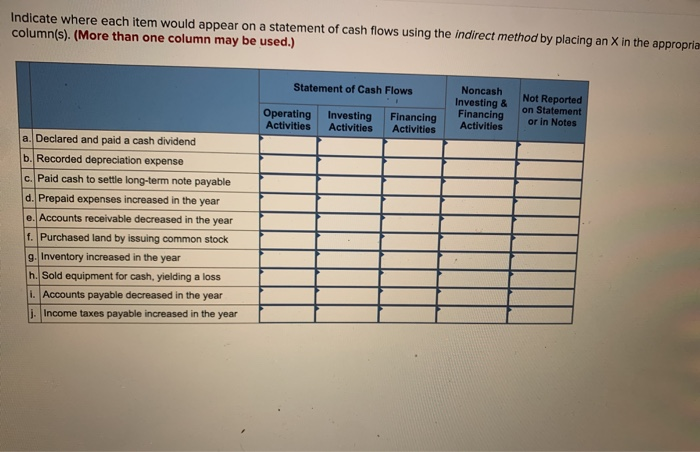

- The disclosure of non-cash activities is done on a company’s cash flow statement.

- In addition to activities that generate cash flows (operating, investing, and financing), companies also engage in investing and financing activities that do not generate any cash flows.

Data Science in Finance: 9-Book Bundle

However, they also can be included as an attachment to the cash flow statement. The entry at the bottom of a cash flow statement would say something such as “Non-cash Investing and Financing Activities” and have a brief description of each non-cash transaction and its monetary value. Alternatively, a separate document labeled “Schedule A,” for example, may be attached to your cash flow statement.

Agency Transactions

These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license.

Statement of Cash Flows for Not-for-Profit Entities

Both methods meet International Financial Reporting Standards and generally accepted accounting standards. The disclosure of non-cash activities is done on a company’s cash flow statement. However, these activities are not included in the body of the statement because no cash was involved. Excluding these activities from your earned income tax credits in california cash flow statement can misrepresent how your company is doing. Your accountant can help you determine which non-cash activities should be included on your cash flow statement. As shown, there are multiple transactions that require special attention during the preparation of a not-for-profit’s statement of cash flows.

Understanding the correct way to report these transactions on the statement of cash flows can help ensure your organization’s financial position is depicted accurately. Investing and financing activities that do not involve cash are not reported in the cash flow statement since there is no cash flow involved. Both options A and C are cash activities that would be reflected on a company’s cash flow statement. Apart from giving you a snapshot of how a business is doing, the cash flow statement is important to investors, potential investors and creditors.

An agency transaction is a type of exchange transaction whereby the not-for-profit entity receives funds that it must pass onto a third party. The receipt of these funds are not reported on the statement of actives, but instead, are reported as a liability on the statement of financial position. When the funds are transferred to the third party, the payment is recorded as a reduction in the liability account. The receipt and disbursement of agency transactions are reported as an operating activity on the statement of cash flows and can be reported either at net or gross when using the indirect method of reporting cash flows. Non-cash investing and financing activities refer to transactions that affect the company’s investment and financing but do not involve actual cash inflows or outflows during the reporting period. These activities are important for understanding a company’s overall financial health as they can have significant implications for future cash flows, even though they don’t impact the cash flow statement directly.

Big decisions can hinge on a healthy or unhealthy looking cash flow statement. To present an accurate accounting of your business it must include non-cash activities that could have an impact. Examples of non-cash activities are issuing stock to pay off a long-term debt or converting preferred stock to common stock.

It allows them to see how well (or not) cash is being managed and what’s being done to generate more cash for ongoing bills and operating expenses. Congrats on reading the definition of non-cash investing and financing activities. Given that the transaction didn’t involve cash, it would have no effect on the cash flow statement. Issuance of common stock in relation to the conversion of preferred stock is an example of a non-cash activity. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Many not-for-profit entities receive donations for which the donor has placed a stipulation that they must be used for long-term purposes, such as the purchase of property and equipment or for endowment funds. These cash receipts are to be reported as financing activities in the statement of cash flows. Some not-for-profit entities have endowment funds, which have donor-imposed restrictions that restrict the use of the income to long-term purposes. Just like the initial receipt of the restricted contribution, the investment income earned on these endowment funds, which is restricted for long-term purposes, must be reported as a financing activity. Also, when using the indirect method of reporting cash flows, cash flows from operating activities will need to be reduced by the amount of investment income received with long-term purpose restrictions, since the investment income is included in the change in net assets, which is an operating activity.

Noncash investing and financing activities that are unique to not-for-profit entities include contributions of (1) property and equipment, (2) beneficial interest in trusts and (3) marketable securities. Cash flows from the purchase, sale or insurance recoveries of capitalized and noncapitalized collection items are reported as investing actives on the statement of cash flows. These non-cash investing and financing activities are reported in a separate disclosure supplement to the statement of cash flows. Examples include stock issued to make an acquisition or items of property, plant and equipment acquired in transactions in which the seller provides debt financing. These transactions result in a transfer of assets, but no cash is involved.