After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

AccountingTools

This step saves a lot time for accountants during the financial statement preparation process because they don’t have to worry about the balance sheet and income statement being off due to an out-of-balance error. Keep in mind, this does not ensure that all journal entries were recorded accurately. The last step in the accounting cycle (not counting reversing entries) is to prepare a post-closing trial balance. They are prepared at different stages in the accounting cycle but have the same purpose – i.e. to test the equality between debits and credits.

Balance Sheet

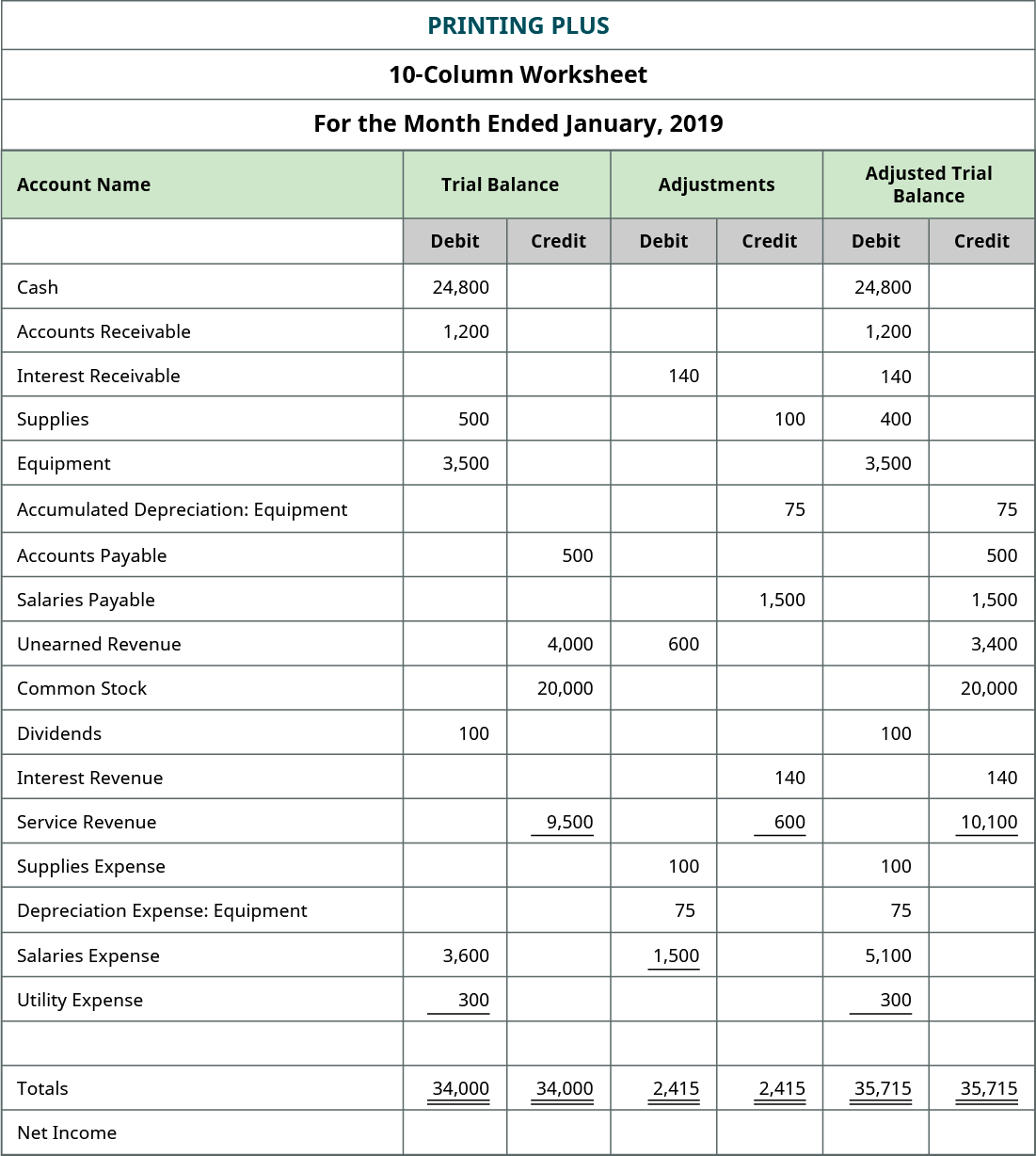

For example, Interest Receivable is an adjusted account that has a final balance of $140 on the debit side. This balance is transferred to the Interest Receivable account in the debit column on the adjusted trial what is an accountant and what do they do balance. Accumulated Depreciation–Equipment ($75), Salaries Payable ($1,500), Unearned Revenue ($3,400), Service Revenue ($10,100), and Interest Revenue ($140) all have credit final balances in their T-accounts.

4 Use the Ledger Balances to Prepare an Adjusted Trial Balance

You have the dividends balance of $100 and net income of $4,665. If you combine these two individual numbers ($4,665 – $100), you will have your updated retained earnings balance of $4,565, as seen on the statement of retained earnings. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. There is no adjustment in the adjustment columns, so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800. Interest Receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column.

When one of these statements is inaccurate,the financial implications are great. When one of these statements is inaccurate, the financial implications are great. Depreciation is a non-cash expense identified to account for the deterioration of fixed assets to reflect the reduction in useful economic life. The adjusting entries for the first 11 months of the year 2015 have already been made. The adjusting entries in the example are for the accrual of $25,000 in salaries that were unpaid as of the end of July, as well as for $50,000 of earned but unbilled sales.

However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present. Transferring information from T-accounts to the trial balance requires consideration of the final balance in each account. Unearned revenue had a credit balance of $4,000 in the trial balance column, and a debit adjustment of $600 in the adjustment column. Remember that adding debits and credits is like adding positive and negative numbers.

Its purpose is to test the equality between total debits and total credits. At the end of an accounting period, the accounts of asset, expense, or loss should each have a debit balance, and the accounts of liability, equity, revenue, or gain should each have a credit balance. On a trial balance worksheet, all of the debit balances form the left column, and all of the credit balances form the right column, with the account titles placed to the far left of the two columns. There are five sets of columns, each set having a column fordebit and credit, for a total of 10 columns. The five column setsare the trial balance, adjustments, adjusted trial balance, incomestatement, and the balance sheet. After a company posts itsday-to-day journal entries, it can begin transferring thatinformation to the trial balance columns of the 10-columnworksheet.

Business owners and accounting teams rely on the trial balance to create reliable financial statements. A trial balance ensures the accuracy of your accounting system and is just one of the many steps in the accounting cycle. As you have learned, the adjusted trial balance is an important step in the accounting process. But outside of the accounting department, why is the adjusted trial balance important to the rest of the organization? An employee or customer may not immediately see the impact of the adjusted trial balance on his or her involvement with the company. As you have learned, the adjusted trial balance is an importantstep in the accounting process.

- Looking at the income statement columns, we see that all revenueand expense accounts are listed in either the debit or creditcolumn.

- However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance.

- For example, let’s assume the following is the trial balance for Printing Plus.

- The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues.

- Just like in the unadjusted trial balance, total debits and total credits should be equal.

- To exemplify the procedure of preparing an adjusted trial balance, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it.

Each month, you prepare a trial balance showing your company’s position. After preparing your trial balance this month, you discover that it does not balance. The debit column shows $2,000 more dollars than the credit column. Note that for this step, we are considering our trial balance to be unadjusted. The unadjusted trial balance in this section includes accounts before they have been adjusted.

This is a reminder that the income statement itself doesnot organize information into debits and credits, but we do usethis presentation on a 10-column worksheet. The 10-column worksheet is an all-in-onespreadsheet showing the transition of account information from thetrial balance through the financial statements. Accountants use the10-column worksheet to help calculate end-of-period adjustments.Using a 10-column worksheet is an optional step companies may usein their accounting process.

Essentially, you are just repeating this process again except now the ledger accounts include the year-end adjusting entries. An adjusted trial balance is formatted exactly like an unadjusted trial balance. Three columns are used to display the account names, debits, and credits with the debit balances listed in the left column and the credit balances are listed on the right. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. Looking at the income statement columns, we see that all revenueand expense accounts are listed in either the debit or creditcolumn.