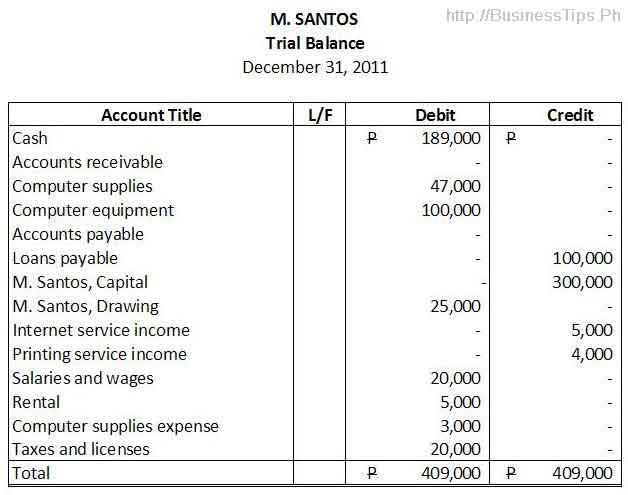

Accountants use the10-column worksheet to help calculate end-of-period adjustments.Using a 10-column worksheet is an optional step companies may usein their accounting process. The adjusting entries are shown in a separate column, but in aggregate for each account; thus, it may be difficult to discern which specific journal entries impact each account. With an adjusted trial balance, necessary adjusting journal entries are incorporated in the trial balance. In the above example, unrecorded liability related to unpaid salaries and unrecorded revenue amount has been included in the adjusted trial balance. Preparing a trial balance for a company serves to detect any mathematical errors that have occurred in the double entry accounting system. If the total debits equal the total credits, the trial balance is considered to be balanced, and there should be no mathematical errors in the ledgers.

5 Prepare Financial Statements Using the Adjusted Trial Balance

Those balances are then reported on respective financial statements. Companies initially record their business transactions in bookkeeping accounts within the general ledger. Depending on the kinds of business transactions that have occurred, accounts in the ledgers could have been debited or credited during a given accounting period before they stripe in xero are used in a trial balance worksheet. Furthermore, some accounts may have been used to record multiple business transactions. As a result, the ending balance of each ledger account as shown in the trial balance worksheet is the sum of all debits and credits that have been entered to that account based on all related business transactions.

5: Prepare Financial Statements Using the Adjusted Trial Balance

Once all of the adjusting entries have been posted to thegeneral ledger, we are ready to start working on preparing theadjusted trial balance. Preparing an adjusted trial balance is thesixth step in the accounting cycle. An adjusted trialbalance is a list of all accounts in the general ledger,including adjusting entries, which have nonzero balances. Thistrial balance is an important step in the accounting processbecause it helps identify any computational errors throughout thefirst five steps in the cycle. Once all of the adjusting entries have been posted to the general ledger, we are ready to start working on preparing the adjusted trial balance. Preparing an adjusted trial balance is the sixth step in the accounting cycle.

AccountingTools

A trial balance is so called because it provides a test of a fundamental aspect of a set of books, but is not a full audit of them. A trial balance is often the first step in an audit procedure, because it allows auditors to make sure there are no mathematical errors in the bookkeeping system before moving on to more complex and detailed analyses. Financial statements drawn on the basis of this version of trial balance generally comply with major accounting frameworks, like GAAP and IFRS. Both US-based companies and those headquartered in othercountries produce the same primary financial statements—IncomeStatement, Balance Sheet, and Statement of Cash Flows. There is a worksheet approach a company may use to make sureend-of-period adjustments translate to the correct financialstatements.

Financial Accounting

Hence the trial balance thus made is the one which includes all considerable adjustments and can be termed an adjusted trial balance. For example, Celadon Group misreported revenues over the span of three years and elevated earnings during those years. The total overreported income was approximately $200–$250 million. This gross misreporting misled investors and led to the removal of Celadon Group from the New York Stock Exchange.

Not onlydid this negatively impact CeladonGroup’s stock price and lead to criminalinvestigations, but investors and lenders were left to wonder whatmight happen to their investment. One of the most well-known financial schemes is that involving the companies Enron Corporation and Arthur Andersen. Enron defrauded thousands by intentionally inflating revenues that did not exist. Arthur Andersen was the auditing firm in charge of independently verifying the accuracy of Enron’s financial statements and disclosures.

- This means we must add a credit of $4,665 to the balance sheet column.

- There are many different internal documents involved, whether you’re looking after your bookkeeping operations in house or outsourcing a professional accountant.

- Journal entries are usually posted to the ledger on a continuous basis, as soon as business transactions occur, to make sure that the company’s books are always up to date.

- The total overreported income was approximately $200–$250 million.

- If the finalbalance in the ledger account (T-account) is a debit balance, youwill record the total in the left column of the trial balance.

It is just for the purpose of explanation, and you don’t need to change the color of account titles in your homework assignments or examination questions. Using Paul’s unadjusted trial balance and his adjusted journal entries, we can prepare the adjusted trial balance. As with all financial reports, trial balances are always prepared with a heading.

If total expenses were more than total revenues, Printing Plus would have a net loss rather than a net income. This net income figure is used to prepare the statement of retained earnings. After the adjusted trial balance is complete, we next preparethe company’s financial statements. After the adjusted trial balance is complete, we next prepare the company’s financial statements.