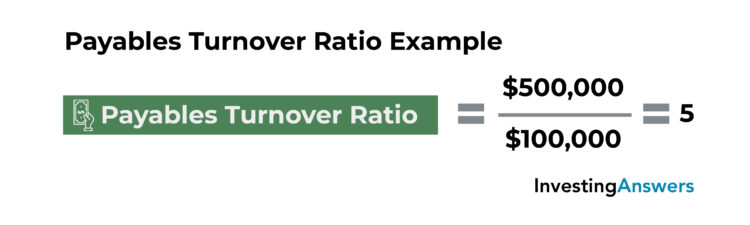

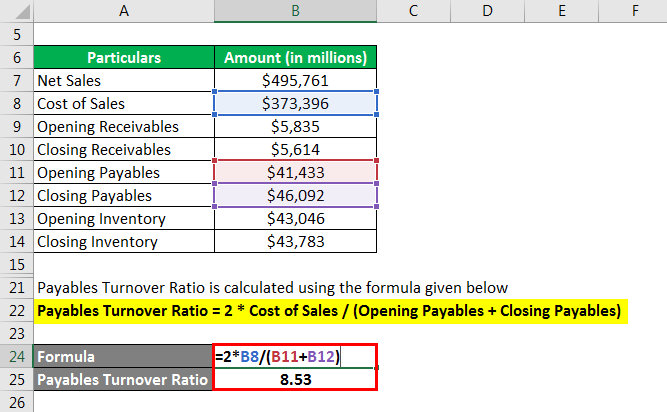

Sometimes cost of goods sold is used in the denominator instead of credit purchases. Accounts payable turnover ratio is a measure of your business’s liquidity, or ability to pay its debts. The higher the accounts payable turnover ratio, the quicker your business pays its debts. This article will deconstruct the accounts payable turnover ratio, how to calculate it — and what it means for your business.

AccountingTools

Improve your accounts payable turnover ratio in days (DPO) by lowering the days payable outstanding to the optimal number that meets your business goals. Accounts Payable Turnover Ratio is a crucial financial metric that measures the efficiency with which a company is managing its accounts payable. It is a financial ratio that helps in the analysis and evaluation of creditor payment policies and procedures. In simple terms, the Accounts Payable Turnover Ratio indicates the number of times a company pays its suppliers, vendors, and other creditors during a specific period. Businesses can track their accounts payable turnover ratios during each accounting period without having to gather additional information.

Record to Report

However, a low accounts payable turnover ratio does not always signify a company’s weak financial performance. Bargaining power also has a significant role to play in accounts payable turnover ratios. For example, larger companies can negotiate more favourable payment plans with longer terms or higher lines of credit. While this will result in a lower accounts payable turnover ratio, it is not necessarily evidence of shaky finances.

Key Performance Indicators (KPIs) to Measure the Effectiveness of Your Accounts Payable Process

- However, a low accounts payable turnover ratio does not always signify a company’s weak financial performance.

- To calculate the accounts payable turnover in days, simply divide 365 days by the payable turnover ratio.

- That means the company has paid its average accounts payable balance 6.25 times during that time period.

- That’s why it’s important that creditors and suppliers look beyond this single number and examine all aspects of your business before extending credit.

- To calculate average accounts payable, divide the sum of accounts payable at the beginning and at the end of the period by 2.

Now let’s have a look at an AP turnover example so you can see exactly how to find this ratio in real life. For example, if you were a car manufacturer, you might look up Ford and discover it has a 5.20 payable turnover for the most recent quarter. Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing. Discover the next generation of strategies and solutions to streamline, simplify, and transform finance operations. See our overall favorites, or choose a specific type of software to find the best options for you. We believe everyone should be able to make financial decisions with confidence.

Common Challenges in Maintaining a Good Accounts Payable Turnover Ratio

A transactions listing is a compiled list of all debits and credits in your general ledger (GL) for a specific period. Therefore, your AP transactions listing lists only debits and credits that hit your accounts payable account. This report can be helpful if you need to see individual journal entries in your GL accounts.

Ready to save time and money?

The Accounts Payable Turnover Ratio measures the number of times a company pays its accounts payable during a given period, typically a year. It is an essential financial metric as it reflects the effectiveness of the company’s credit and payment policies. A high Accounts Payable Turnover Ratio indicates that a company has an efficient and timely payment system, which is important in maintaining a good relationship with vendors and suppliers. Since the accounts how to accept payments online payable turnover ratio indicates how quickly a company pays off its vendors, it is used by supplies and creditors to help decide whether or not to grant credit to a business. As with most liquidity ratios, a higher ratio is almost always more favorable than a lower ratio. Like other accounting ratios, the accounts payable turnover ratio provides useful data for financial analysis, provided that it’s used properly and in conjunction with other important metrics.

If your AP turnover target is lower than your ratio today, you’ll need to pay your bills more slowly. It’s important to make those decisions carefully, putting a system in place to decide which bills you can afford to pay later and which you can’t. Just remember to pay attention to the time period so you can calculate the AP turnover for the same period. Companies that have busy AP departments with many bills and payments often start by looking at their AP turnover over a 5-day or 10-day period. If your business relies on maintaining a line of credit, lenders will provide more favourable terms with a higher ratio.

In the vast landscape of business operations, many factors contribute to a company’s success and financial health. While some aspects may take center stage, others quietly operate beneath the surface, yet have significant influence. One crucial aspect that quietly influences its financial health is accounts payable. Comparing your company’s ratio with industry averages can provide insights into how your company is performing compared to its competitors. You can obtain industry averages from various sources such as industry associations, credit agencies, and financial publications.

It’s important that the accounts payable turnover ratio be calculated regularly to determine whether it has increased or decreased over several accounting periods. Drawbacks to the AP turnover ratio relate to the interpretation of its meaning. How does the accounts payable turnover ratio relate to optimizing cash flow management, external financing, and pursuing justified growth opportunities requiring cash?

Accounts payable and accounts receivable turnover ratios are similar calculations. AP aging comes into play here, too, since it digs deeper into accounts payable and how any outstanding debt could affect future financials. An AP aging report allows you to organize the total amount due into 30-day “buckets”, so you can track payments that are due and payments that are overdue. If your AP turnover isn’t high enough, you’ll see how that lower ratio affects your ongoing debt. Startups are particularly reliant on AP aging reports for startup cash flow forecasting and runway planning. Whether you aim to increase your turnover ratio to free up cash flow or negotiate extended payment terms to preserve capital, strategic management of accounts payable is key.

A low Accounts Payable Turnover Ratio may indicate that a company is experiencing cash flow problems, supplier relationship issues or may be taking advantage of extended payment terms. It is crucial to compare the ratio with industry benchmarks and analyze the components of the ratio to interpret the results correctly. Your accounts payable turnover ratio tells you — and your vendors — how healthy your business is. Comparing this ratio year over year — or comparing a fiscal quarter to the same quarter of the previous year — can tell you whether your business’s financial health is improving or heading for trouble. Even if your business is otherwise healthy, having a low or decreasing accounts payable turnover ratio could spell trouble for your relationship with your vendors.