Additionally, cloud-based inventory management systems are often real-time, a key element of a perpetual inventory system. Note that for a periodic inventory system, the end of the period adjustments require an update to COGS. To determine the value of Cost of Goods Sold, the business will have to look at the beginning inventory balance, purchases, purchase returns and allowances, discounts, and the ending inventory balance. Table6.1 There are severaldifferences in account recognition between the perpetual andperiodic inventory systems. Note that for a periodic inventory system, the end of the periodadjustments require an update to COGS.

What Is LIFO Perpetual Inventory Method?

For example, a grocery store uses products with barcodes, which are then scanned at checkout. The scan triggers the inventory management system to automatically deduct the purchased units and update them as needed and will constantly track the stock level of each product. Square accepts many payment typesand updates accounting 5 payment reminder templates to ask for overdue payments records every time a sale occurs through acloud-based application. This enhanced product allowsbusinesses to connect sales and inventory costs immediately. Abusiness can easily create purchase orders, develop reports forcost of goods sold, manage inventory stock, and update discounts,returns, and allowances.

Products

When the company sells merchandise, the perpetual software records two transactions. First, the software credits the sales account and debits the accounts receivable or cash. Second, the software debits the COGS for the merchandise and credits the inventory account. Square accepts many payment types and updates accounting records every time a sale occurs through a cloud-based application. Square, Inc. has expanded their product offerings to include Square for Retail POS.

FAR CPA Practice Questions: Capital Account Activity in Pass-through Entities

- A sales allowance and sales discount follow the same recording formats for either perpetual or periodic inventory systems.

- Additionally, cloud-based inventory management systems are often real-time, a key element of a perpetual inventory system.

- At the time of the sale on September 1, the latest cost of the 3 units sold was $11 each.

- The $85 cost that was assigned to the book sold is permanently gone from inventory.

- Note that for a periodic inventory system, the end of the periodadjustments require an update to COGS.

A company may not have correct inventory stock and could make financial decisions based on incorrect data. There are some key differences between perpetual and periodicinventory systems. When a company uses the perpetual inventorysystem and makes a purchase, they will automatically update theMerchandise Inventory account. Under a periodic inventory system,Purchases will be updated, while Merchandise Inventory will remainunchanged until the company counts and verifies its inventorybalance. This count and verification typically occur at the end ofthe annual accounting period, which is often on December 31 of theyear.

Generally Accepted Accounting Principles (GAAP) do not state arequired inventory system, but the periodic inventory system uses aPurchases account to meet the requirements for recognition underGAAP. The main difference isthat assets are valued at net realizable value and can be increasedor decreased as values change. We’ll use a simplified example where ABC Widgets buys and sells only one widget during a given accounting period. Not only must an adjustment to Merchandise Inventory occur at the end of a period, but closure of temporary merchandising accounts to prepare them for the next period is required. Temporary accounts requiring closure are Sales, Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold. Sales will close with the temporary credit balance accounts to Income Summary.

There are more chances for shrinkage, damaged, or obsolete merchandise because inventory is not constantly monitored. Since there is no constant monitoring, it may be more difficult to make in-the-moment business decisions about inventory needs. So, under the perpetual inventory method, we calculated COGS for the period of $99,100—but we didn’t know that exact amount until we took a physical count. In this final approach to maintaining and reporting inventory, each time that a company buys inventory at a new price, the average cost is recalculated.

On January 2, FitTees purchased 2,000 units of designer shirts from a new supplier, FRESH Distributors, Inc. for cash at $28 per unit. Sales Discounts, Sales Returns and Allowances, and Cost of GoodsSold will close with the temporary debit balance accounts to IncomeSummary. Large companies or those with complex inventories are well suited to a perpetual system. Smaller companies with limited inventory can often survive with a periodic system. The same applies to the margin for error, which is lower with a perpetual system, although a limited, uncomplicated inventory may not suffer much with a periodic system.

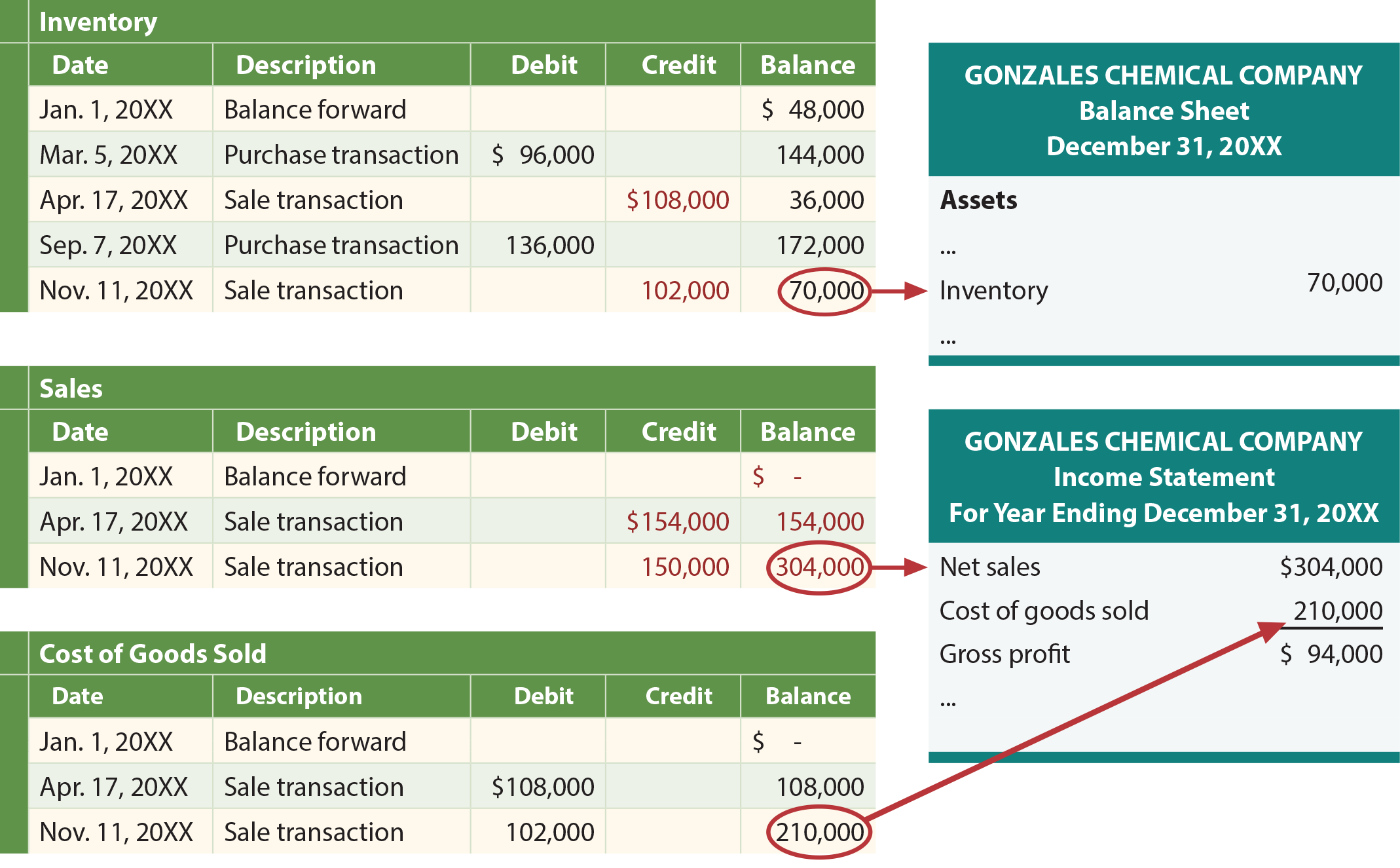

The Merchandise Inventory account balance is reported on thebalance sheet while the Purchases account is reported on the IncomeStatement when using the periodic inventory method. The Cost ofGoods Sold is reported on the Income Statement under the perpetualinventory method. This card shows the starting inventory, sales, purchases, prices and balances. Under a perpetual system, inventory records for this product are continually changing.

Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold will close with the temporary debit balance accounts to Income Summary. Notice the COGS and Inventory figures at the end of the year are exactly the same under both methods. The difference is that with the perpetual system, you know the exact COGS throughout the period. On January 2, FitTees purchased 2,000 units of designer shirts from a new supplier, FRESH Distributors, Inc. for cash worth at $28 per unit.

Note that this $21 is different than the gross profit of $20 under periodic LIFO. The costing results of a perpetual LIFO system are more common than a periodic LIFO system, since most inventory is now tracked using computerized systems that maintain inventory records on a real-time basis. If Corner Bookstore sells the textbook for $110, its gross profit using the periodic average method will be $22 ($110 – $88).