The periodic inventory approach was very well-liked before technology accounting solutions were introduced. There was no denying its shortcomings, but most business owners believed its advantages exceeded them. It’s interesting to note that the method is still widely used today, and many business owners prefer it to the perpetual inventory system. Businesses that don’t have a daily requirement to correctly know their current inventory levels might benefit from periodic inventory.

- As long as the business owner is willing to put in the time to count inventory and calculate the cost of goods sold, there’s no business expense to the periodic inventory system.

- When a business sells merchandise, only one journal entry is made to recognize the sale.

- The periodic inventory system is one of the simplest and oldest inventory tracking processes.

- On the other hand, in a periodic inventory system, inventory reports and the cost of goods sold aren’t kept daily, but periodically, usually at the end of the year.

- The above are the two types of stockpile tracking and management system that companies use according to their rules and requirements.

What is the purpose of determining the cost of goods sold and ending inventory?

Perpetual inventory systems are designed to maintain updated figures for inventory as a whole as well as for individual items. Separate subsidiary ledger accounts show the balance for each type of inventory so that company officials can know the size, cost, and composition of the merchandise. A periodic system is cheaper to operate because no attempt is made to monitor inventory balances (in total or individually) until financial statements are to be prepared. A periodic system does allow a company to control costs by keeping track of the individual inventory costs as they are incurred. The biggest disadvantages of using the perpetual inventory systems arise from the resource constraints for cost and time. This may prohibit smaller or less established companies from investing in the required technologies.

Should You Use This Method for Your Inventory Records?

Because there’s no constant inventory tracking, it can be difficult for a firm to be aware of which goods are running low on stock, or if there’s an excess supply for a type of inventory. Through a perpetual system, businesses are also able to access inventory reports at all times, and reduce human error through automation. The above are the two types of stockpile tracking and management system that companies use according to their rules and requirements. No matter which type of system is chosen, it is important to ensure that it is regularly updated and maintained to ensure accuracy in the stock records. Regular audits and checks should also be conducted to ensure that the system is working correctly and is up to date.

Minimal Resources and Costs

The periodic inventory approach is primarily used by small businesses that deal with very few transactions, or companies that only have a limited number of inventory. When merchandise is sold, an entry is made to record the sales revenue, but none to record the cost of goods sold, or to reduce the inventory. Consequently, there are no merchandise inventory account entries during the period. A simplified form of the above journal entry uses a single debit or credit to inventory account by calculating the difference of ending inventory and beginning inventory.

We invite you to explore our platform for all of your business needs — you’ll find free business templates, software products, and informative articles. This lack of information can result in a loss of possible revenue and sales opportunities. Now, keep in mind that the previously mentioned advantages only benefit small businesses that deal with a couple of hundred sales a year. All that gets recognized are purchases, and inventory is only counted at the end of the year.

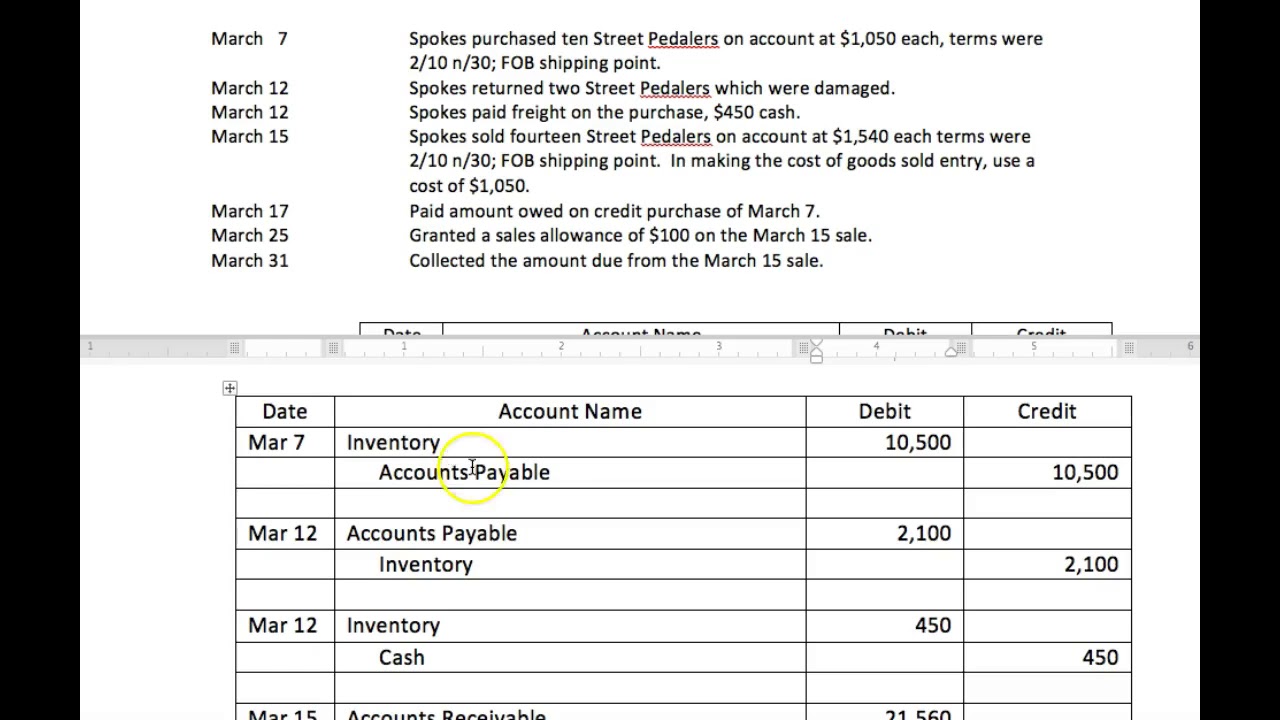

Paying for Inventory Purchased on Credit

The Purchases account, which is increased by debits, appears with the income statement accounts in the chart of accounts. Similar to purchase returns and discounts, company has to record them into the accounting system. The record will impact the accounts receivable and net off with sale revenue. The journal entry is debiting sale discount/sale return and credit accounts receivable. Properly managing inventory can make or break a business, and having insight into your stock is crucial to success.

These enterprises include modest cafés, restaurants, auto dealerships, art galleries, and so on. Here, we’ll briefly discuss these additional closing entries and adjustments as they relate to the perpetual inventory system. To maintain consistency, we’ll use the same example from FIFO and LIFO above to the calculate weighted average.

At the end of the year, or at the end of any other timing interval businesses choose, a physical inventory count is done, to recognize the amount of remaining inventory. That’s why a periodic inventory system is only mainly used by small businesses with limited inventory and few financial transactions. Once the ending inventory and cost of goods sold are clarified, the accounts require adjustment to reflect the ending inventory balance and the cost of goods sold.

Thus, the above are some characteristics of periodic inventory system which some companies follow to make their system efficient and transparent. Similarly if there is a shortage, that may hinder the production and lead to mismanagement in the operation of the business. The system is also less flexible than other types of inventory systems, which can make it difficult to adjust to changing inventory needs. The periodic system is designed to take inventory at predetermined intervals, which can limit the ability to adjust to different circumstances. This can lead to inefficient use of resources and can cause problems when responding to sudden changes in demand.

“Dollar stores,” which have become particularly prevalent in recent years, sell large quantities of low-priced merchandise. Goods tend to be added to a store’s inventory as they become available rather than based on any type of managed inventory strategy. Again, officials must decide whether keeping up with the inventory on hand will impact their decision making. see whats new with estimates and invoices in quickbooks online Visual inspection can alert the employees as to the quantity of inventory on hand. Sales Discounts, Sales Returns and Allowances, and Cost of Goods Sold will close with the temporary debit balance accounts to Income Summary. Perpetual inventory is the system in which company keeps track of each inventory item level since it was purchase and sold to the customer.

At the beginning of the month, they have $10,000 worth of clothing in stock (their beginning inventory). Throughout the month, they purchase additional clothing worth $5,000, and they don’t keep track of inventory changes with every sale. In short, if you prefer simplicity and don’t need to track your inventory constantly, the periodic system might be for you. But if you want to know your inventory levels at all times and can handle the complexity, the perpetual system could be the better choice. When a business sells merchandise, only one journal entry is made to recognize the sale. Small inventory levels and limited stock won’t take more than a couple of hours to count, and the cost of goods sold can be estimated through very few simple calculations.